Ethereum 2.0, the much-anticipated upgrade to the Ethereum network, is set to revolutionize the blockchain landscape with its shift from the energy-intensive Proof of Work (PoW) consensus mechanism to the more environmentally friendly Proof of Stake (PoS). In this article, we’ll delve deep into the world of staking on Ethereum 2.0 and explore effective strategies to maximize your returns while minimizing risks. Additionally, if you want to know more about investments and firms, you may visit the ethereumcode.app.

Understanding Ethereum 2.0

Transition from Ethereum 1.0

Ethereum 2.0 represents a fundamental upgrade from the original Ethereum 1.0 network. The primary goal is to enhance scalability, security, and sustainability while reducing energy consumption. Ethereum 2.0 introduces a phased transition, with the PoS beacon chain as its cornerstone.

Key Features and Benefits

Ethereum 2.0 offers several compelling features, including sharding, which allows parallel processing of transactions, and a PoS mechanism that eliminates the need for energy-intensive mining. This upgrade promises faster transaction processing, lower fees, and increased network security.

Role of Validators

Validators are the backbone of Ethereum 2.0’s PoS system. They propose and validate blocks, securing the network and maintaining its integrity. To participate in staking, users need to become validators by staking a certain amount of cryptocurrency as collateral.

Staking Basics

What is Staking?

Staking is the process of locking up a specific amount of cryptocurrency as collateral to support the network’s operations. In return, validators earn rewards for their contributions.

Staking Tokens

Validators must stake a specific amount of cryptocurrency as collateral, which varies depending on network rules. In Ethereum 2.0, the native cryptocurrency, ETH, is staked to become a validator.

Rewards and Penalties

Validators are incentivized with rewards for validating transactions and creating new blocks. However, there are penalties for malicious behavior or downtime, ensuring the security and efficiency of the network.

Selecting the Right Hardware and Software

Hardware Requirements

To become an Ethereum 2.0 validator, you need reliable hardware with sufficient computing power and a stable internet connection. Investing in high-quality hardware is crucial for uninterrupted validation.

Software Options

Various software clients, such as Prysm, Nimbus, and Lighthouse, are available for Ethereum 2.0 staking. Selecting the right client and configuring it properly is essential for successful staking.

Security Considerations

Security is paramount in staking. Safeguarding your private keys and ensuring the security of your validator setup is critical to protect your staked assets from potential threats.

Staking Strategies

Long-term vs. Short-term Staking

Stakers can choose between long-term and short-term strategies. Long-term stakers commit their assets for extended periods, while short-term stakers remain more flexible. Each approach has its advantages and drawbacks.

Pool Staking vs. Solo Staking

Pool staking involves collaborating with other validators to pool resources, increasing the chances of receiving rewards. Solo staking allows greater control but carries higher risks. Diversifying between both can help balance risk and reward.

Diversification of Staked Assets

Reducing risk through diversification involves staking assets across multiple validators or networks. This strategy minimizes the impact of potential slashing penalties on your overall staked assets.

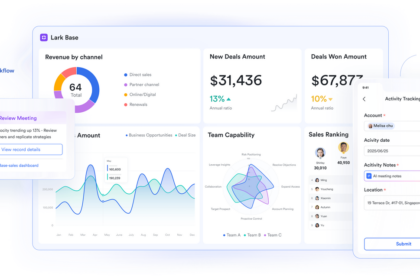

Maximizing Returns

Understanding Staking Rewards

Staking rewards on Ethereum 2.0 are determined by factors like the total amount staked, network participation, and the chosen staking strategy. Understanding these dynamics is essential for optimizing returns.

Strategies for Optimization

Maximizing returns involves staying informed about network upgrades, participating actively as a validator, and employing effective monitoring tools. Regularly compounding rewards can also boost your staking gains over time.

Risks and Challenges

Security Risks

Staking involves securing a significant amount of cryptocurrency, making validators potential targets for attacks. It is crucial to implement robust security measures to protect your assets.

Network Upgrades and Rule Changes

Ethereum 2.0 is a dynamic network, subject to rule changes and upgrades. Validators must stay informed about these changes to adapt their strategies accordingly.

Legal and Tax Considerations

Staking may have legal and tax implications depending on your jurisdiction. Consult with experts and comply with local regulations to avoid any potential legal issues.

Conclusion

In conclusion, Ethereum 2.0’s transition to Proof of Stake has opened up exciting opportunities for users to participate in securing and validating the network. By understanding the basics of staking, selecting the right hardware and software, and implementing effective staking strategies, you can maximize your returns while navigating potential risks. As Ethereum 2.0 continues to evolve, responsible staking practices will play a vital role in its long-term success and sustainability.